The fund's goal is to build up a diversified portfolio of infrastructure projects and companies, and to generate an attractive return through regular dividends and by increasing the value of the fund units. The fund invests equity into minority and majority shares of Brownfield and Greenfield assets with Core and Core+ risk profiles. It focuses on mid-market transactions inside Europe/the Eurozone. The objective is to build up a portfolio of 8-10 investments over a five-year investment period.

The objective of the MEAG European Infrastructure One fund is an IRR of 9-11% across the fund's term, and a cash yield of around 4% p.a.

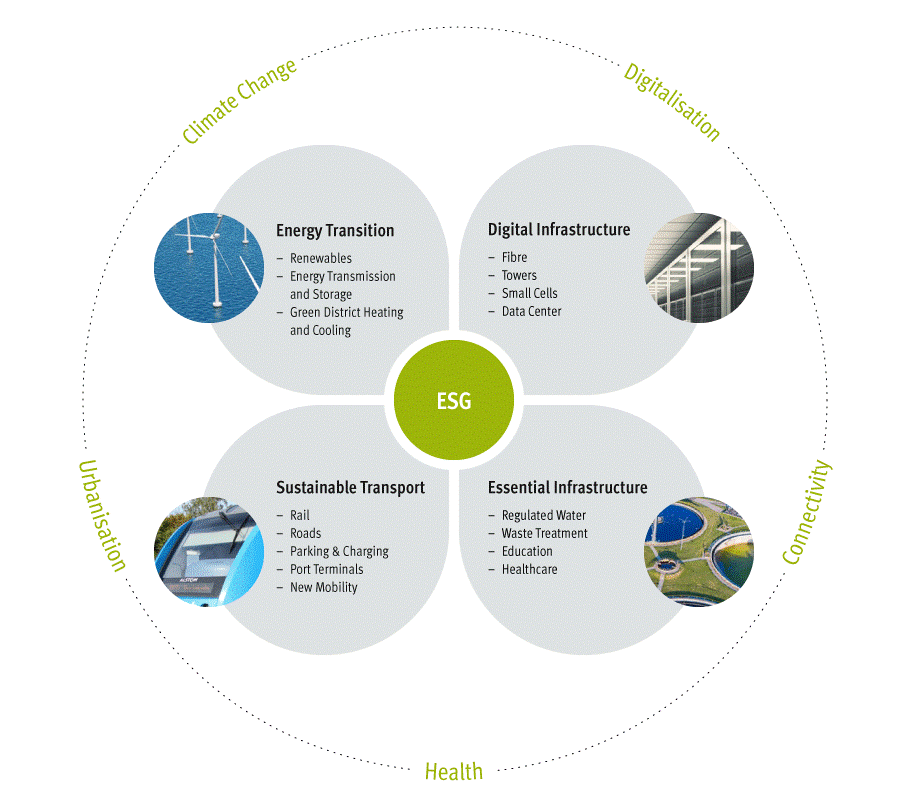

The fund is classified in accordance with Article 8 of the EU Disclosure Regulation, and invests in the following ESG-oriented infrastructure sectors, in line with global megatrends:

Within these sectors, the fund focuses on companies with a high cashflow visibility, which can be achieved, for instance, by means of long-term contracts, predictable regulatory frameworks or high market-entry barriers.

The fund has a term of 20 years, during which it pursues a long-term buy-and-hold strategy, using active asset management to actively reduce or control risks and leverage additional earnings potential.

The MEAG European Infrastructure One fund is a closed-end Alternative Investment Fund under Luxembourg law (Reserved Alternative Investment Fund – RAIF).